Self Custody

Bitcoin was built to give individuals true financial sovereignty — but that only works if you control your own keys. Self-custody means holding your Bitcoin in a wallet you control, without relying on exchanges or third parties.

Why it matters:

Eliminate counterparty risk – No one can freeze, hack, or mismanage your funds.

True ownership – You’re not holding an IOU; you hold the asset itself.

Privacy and security – Manage your wealth without exposing personal information to unnecessary platforms.

How we help:

We guide you through every step of setting up secure wallets, understanding backups, and adopting best practices. Whether you’re new to Bitcoin or moving off exchanges, we make self-custody simple and safe.

Collaborative Custody

For those holding significant Bitcoin or managing shared funds, multisignature wallets (multisig) offer a powerful upgrade to your security. Instead of relying on a single key, multisig requires multiple keys to move your Bitcoin — adding layers of protection against loss, theft, or mistakes.

How it works:

A typical setup might require 2 of 3 keys (2-of-3) to authorize a transaction. You control some keys, and trusted parties or secure storage solutions hold the others. No single compromised key can put your funds at risk.

Benefits of Multisig:

Resilient security – Protects against hacks, device failure, or user error.

Shared control – Ideal for families, businesses, trusts, or collaborative custody.

Customizable setup – We tailor the key structure to fit your needs and risk profile.

How we help:

We design and deploy multisig setups with you, ensuring you understand how to manage, recover, and maintain control — without complexity or confusion.

Secure your Bitcoin like it matters — because it does.

Products to Consider

UTXO Management

Every Bitcoin you own is made up of UTXOs — unspent transaction outputs. Think of them like individual bills in your digital wallet. Proper UTXO management ensures you stay in control of how those “bills” are combined and spent, which directly impacts your privacy, transaction fees, and long-term security.

Why it matters:

Lower fees – Efficiently consolidate UTXOs when fees are low to save money later.

Better privacy – Avoid revealing your full balance every time you spend.

Improved security – Organize coins by purpose (savings vs. spending) and reduce traceability risks.

How we help:

We teach you how to view and manage UTXOs in compatible wallets, plan consolidations, and use coin control best practices — giving you finer control over your Bitcoin without unnecessary complexity.

Dollar Cost Averaging (DCA)

Dollar-Cost Averaging (DCA) is a simple strategy where you invest a fixed amount into Bitcoin on a regular schedule — daily, weekly, or monthly — regardless of price. Over time, this smooths out volatility and removes the stress of trying to “time the market.”

Example: Apps like Strike make DCA easy by letting you schedule automatic Bitcoin purchases straight from your bank account. It’s a hands-off way to steadily grow your position while staying disciplined.

Seed Phrase Recovery

Your seed phrase (also called a recovery phrase) is the master key to your Bitcoin. If you lose access to your wallet but still have the seed phrase, you can fully restore your funds. However, improper recovery steps can put your Bitcoin at risk.

When to recover a seed phrase:

You’ve lost your original device or wallet

You’re migrating to a new wallet or hardware device

You’re consolidating multiple wallets for simpler management

Why it’s critical to do it right:

Entering your seed phrase on a compromised device can expose your funds

Phishing and fake wallet apps are common attack vectors

Proper verification ensures you’re restoring the correct funds safely

How we help:

We guide you through secure, offline recovery and confirm wallet balances without risking exposure — ensuring you regain access without compromising your Bitcoin.

Setting Up a Bitcoin Node

A Bitcoin node is software that downloads and verifies the entire blockchain. Running your own node allows you to independently validate transactions, improve privacy, and contribute to the health of the Bitcoin network.

Pros of Running a Node

Verify, don’t trust – Confirm transactions yourself instead of relying on third parties.

Enhanced privacy – Your wallet queries the blockchain directly, without leaking data to external servers.

Support the network – Nodes help keep Bitcoin decentralized and censorship-resistant.

Custom features – Enable advanced setups like multisig, coin control, or Lightning.

Cons of Running a Node

Hardware and storage – Requires a dedicated device and ~1TB of disk space (and growing).

Initial setup time – Full sync can take several days, depending on hardware and internet speed.

Maintenance – Occasional software updates and uptime monitoring are needed.

How we help:

We provide guidance on selecting hardware (e.g., Raspberry Pi vs. dedicated mini-PC), configuring your node securely, and integrating it with your wallet — so you get the benefits without the headaches.

Bitcoin Not Crypto

When people say “crypto,” they often lump Bitcoin together with thousands of altcoins — tokens that try to mimic or improve on Bitcoin but fail to address its core purpose: sound, decentralized money.

Bitcoin is fundamentally different:

Truly decentralized – No central company or foundation controls Bitcoin.

Proven security and track record – Over a decade without compromise.

Fixed supply – 21 million coins, verifiable by anyone running a node.

Global liquidity and adoption – The most widely held and recognized digital asset.

Why Altcoins Fall Short

Many altcoins — especially those used in online casinos — sacrifice security and decentralization for speed or gimmicks. They often rely on centralized issuers or exchanges, making them vulnerable to frozen funds, regulatory crackdowns, or outright fraud.

Case in point: XRP (Ripple)

Controlled and issued by a single company (Ripple Labs)

Regularly embroiled in lawsuits and regulatory battles (e.g., SEC case)

Designed for banking intermediaries, not individual financial sovereignty

These characteristics put XRP — and similar casino-style tokens — at odds with Bitcoin’s core ethos of censorship resistance and self-sovereignty.

Below I’ve included a fun look back on 2017. Looks a lot different than the current Coinmarketcap leaderboard.

Retirement Planning

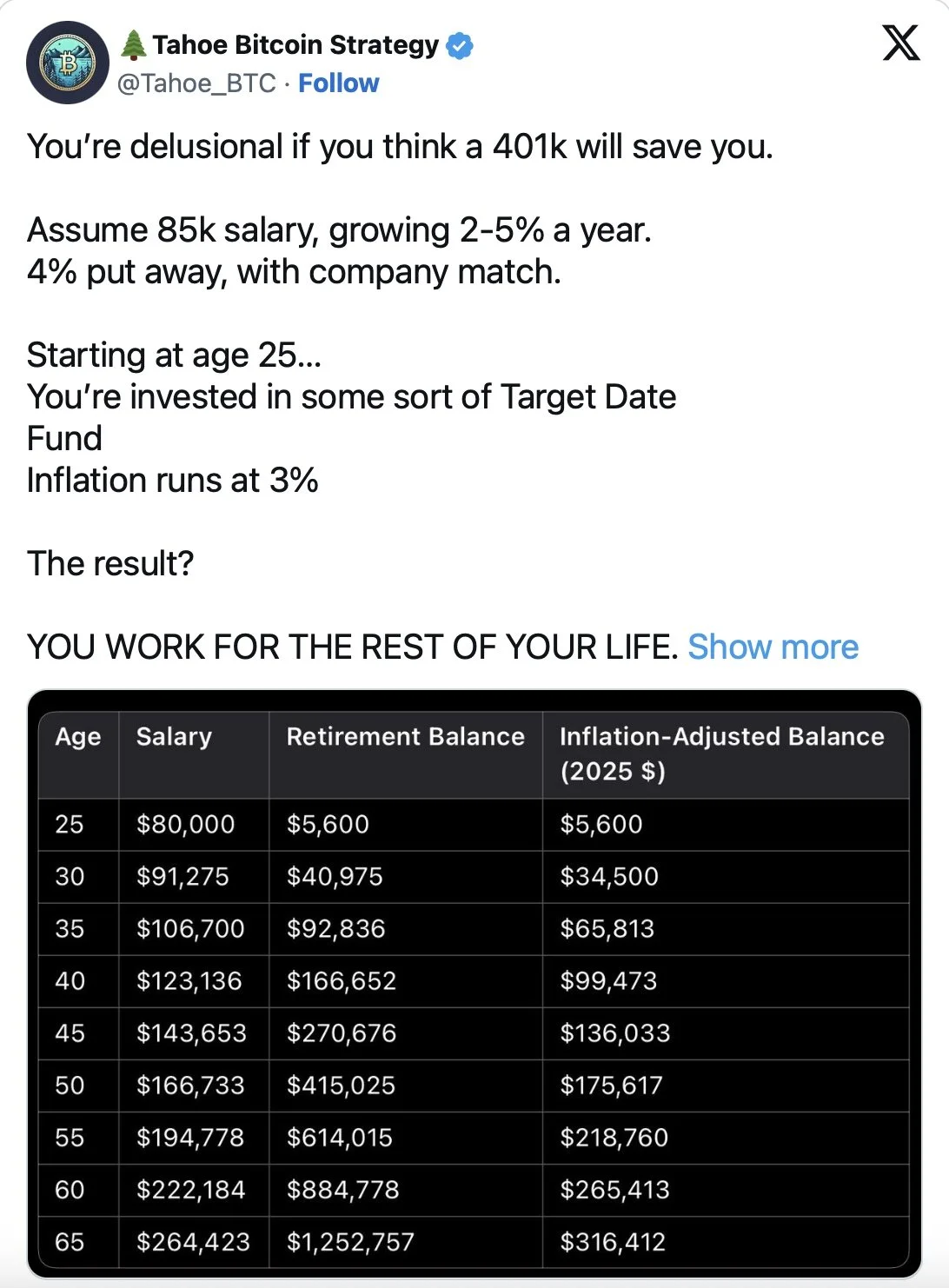

These days the standard target date funds that 401k holders get subscribed to aren’t enough.

Bitcoin provides the extra push your portfolio needs to actually have a chance at retirement.

There are several ways to get Bitcoin exposure in your retirement portfolio:

Mega-backdoor ROTHs

Self allocated funds

Independent IRAs

Choosing one of the options above will then allow you to get exposure via the ETFs, shared custody Bitcoin, or even proxies like $MSTR.